- Sustainable and responsible investing (SRI) is a growing trend among investors who want their values reflected in their portfolio.

- To align your capital allocation with your goals, you can adopt an inclusionary or exclusionary approach.

- As is the case with most investing, a little flexibility and staying up-to-date with SRI developments can go a long way.

If you’re interested in making the most of your portfolio through sustainable and responsible investing (SRI), you’re certainly not alone. In 2020, individual investors in the U.S. had $4.6 trillion in sustainable investments, a 50% increase from 2018.1

Integrating SRI into your overall portfolio allows you to use your money for valuable investments that consider environmental, social and governance issues, while still working toward the ultimate objective of growing your overall wealth. Here are some ways to do that.

Step 1: Determine what your SRI goals are.

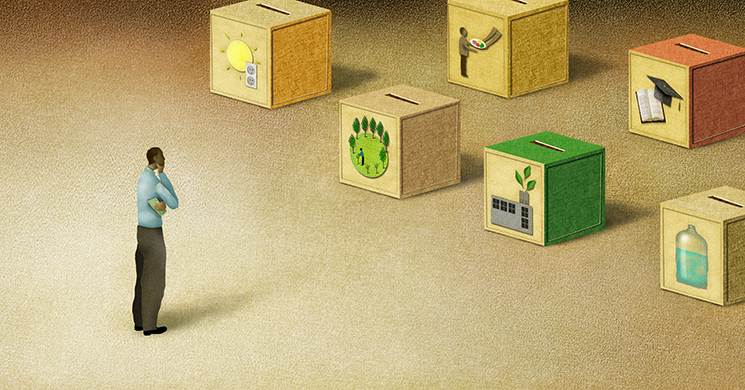

Your investment dollars can be used in several ways for the greater good. It helps to understand what some common investment options are before diving in. Choices include:

- Climate change: Some larger businesses have been making climate change a goal of their overall endowment capital investment missions, and it’s certainly a noble issue to consider. For example, BlackRock and Vanguard were successful in introducing a resolution that requires ExxonMobil to issue an annual report addressing the impacts of climate change on its business.2 On the personal side, if climate change is an issue you care about, consider looking into investments that lower your fossil fuel exposure, invest more in green companies or engage with corporate management on climate issues of importance to you.

- Gun safety: Gun violence is an issue that plagues many, and it’s easy to feel like your hands are tied. One way to make a difference is through your investing. As far as large companies go, the majority of shareholders of gun manufacturer Sturm, Ruger & Co. Inc. voted in favor of requiring the company to produce a report that addresses how it tracks violence with its firearms, what kind of research it is conducting related to so-called smart gun technology, and its assessment of the risk that gun-related crimes pose to the company’s reputation and finances.3 To do your part, consider investment solutions that screen out firearm manufacturers or focus on corporate engagement that supports common sense gun safety and new gun safety technology.

- Diversity and inclusion: Investing in companies that celebrate and promote diversity and inclusion not only helps propel those companies forward in their mission, but companies that focus on diversity also create a business framework that improves problem-solving and creativity, thereby increasing their overall odds for success. For example, some evidence finds that firms with 10% more female directors on their board are associated with 6% more patents.4 Do some research on the policies and hiring practices of different companies before investing to focus on this objective.

Step 2: Align your capital allocation with your goals.

To incorporate your SRI goals into your portfolio, you’ll not only want to determine where your money will be best allocated, but you’ll also want to figure out where you might want to divert current investments from companies that don’t align with your goals. There are two ways to go about this. An inclusionary approach — or positive screening, as it’s often referred to— allows you to allocate investments toward companies that exhibit characteristics that align with your values. Examples include companies that promise to have a low carbon footprint, work with a diverse board (like having a certain percentage of women and/or minorities on their board) or focus on income inequality (e.g., CEO-to-median employee compensation).

Alternatively, an exclusionary approach — often referred to as negative screening — avoids allocating investments toward companies with characteristics that do not align with your values. These could include companies, for example, that derive large portions of their revenue from goods and services related to tobacco, firearms or private prisons.

Step 3: Stay informed.

More SRI-related investment funds are coming to market, and new investment technology is making it easier than ever before to make customization accessible to the average investor, thereby increasing the ease of SRI. Stay up to date on the developments in this field and take your time with your SRI goals.

As is the case with most investing, a little flexibility can go a long way. Let your established objectives be a guidepost for current and future investing, and you’ll be able to not only grow your portfolio, but also do so in a manner that aligns with your values. When you’re ready to start implementing SRI into your portfolio, our advisors are here to help.

1. “US SIF Biennial Trends Report,” The Forum for Sustainable and Responsible Investing, November 2020

2. “Financial Firms lead shareholder rebellion against ExxonMobil climate change policies,” The Washington Post, Steven Mufson, May 31, 2017.

3. “Sturm Ruger Shareholders Adopt Measure Backed by Gun Safety Activists,” The New York Times, May 8, 2018.

4. “Why Invest in Companies That Focus on Inclusion and Diversity,” Seeking Alpha, November 7, 2018.