For a wealth manager who is charged with the task of protecting and growing your money, honing in on your goals and objectives is the first step in determining the investment strategy that leads to the all-important asset allocation decision. Asset allocation is the main determinant for investment performance, but we believe protection of assets and management of risk also are essential for a successful long-term investment plan.

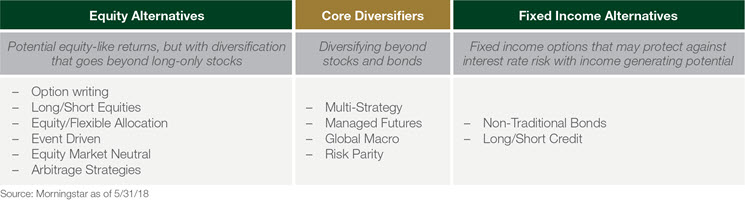

Traditionally, asset allocation and risk management were as simple as looking at a balance between stocks and bonds. But as wealth managers continued to look for ways to improve returns and reduce risk, it led to venturing out and exploring other investment solutions, or alternatives. Fast-forward to today and alternatives include private equity, hedge funds, diversified multi-asset strategies, managed futures, real assets and other liquid alternatives.

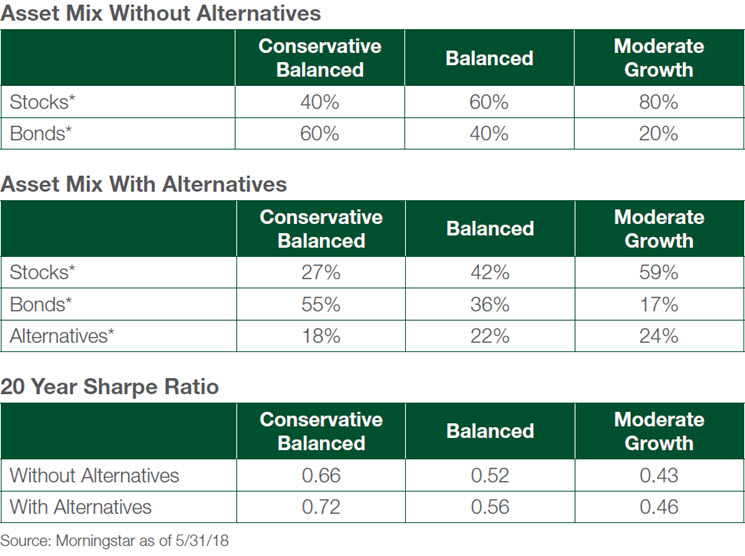

There are two aims to incorporating these asset classes into portfolios: 1) improve overall portfolio returns and 2) reduce overall risk through assets that are not directly correlated to stocks and bonds. The following table reflects the historic risk adjusted performance (Sharpe Ratio) for portfolios that have alternatives against portfolios without alternatives. When compared to traditional portfolios made up of only stocks and bonds, portfolios with alternatives may provide a better risk adjusted return.

(Note: Sharpe Ratio is calculated by dividing the portfolio's annualized excess return over the risk free rate by the standard deviation of the portfolio's annualized excess return. The risk free is the three month U.S. Treasury Bill. In the previous table, stocks are defined by the S&P 500 Index. Bonds are defined by the Bloomberg Barclays U.S. Bond Aggregate and Alternatives is defined as the HFRI Fund of Funds Index.)

Less than 15 years ago, many of these investments were deemed off-limits to the average investor and best left to the big institutions that have multibillion-dollar endowments and could afford to place a segment of their portfolios in these unregulated asset classes. But as these portfolios reflected outsized performance compared to their peer groups, more attention was given to this area, and these strategies have now become mainstays marketed to the individual, high net worth investor.

Clients were touting their hedge fund managers, as they compared their (again) outsized returns to their diversified portfolio of stocks, bonds and cash. As long as these above-average returns were produced, it didn’t matter that their money was tied up — without the ability to redeem for three, six or 12 months. The monthly statements were coming in and portfolio returns were increasing at dramatic rates. Then came 2008.

During the financial crisis, liquidity dried up and people began to get concerned — some even panicked. It was a very uncomfortable time for most investors, no matter what markets you were involved in. We speak about correlation and the power of diversified portfolios, but in 2008 and early 2009, the majority of assets went in one direction — down. At least if you were in stocks and investment-grade bonds, you could sell them if you wanted to. But the many investors who had been enjoying the fruits of hedge fund returns in prior years were suddenly concerned about getting their hands on their funds that were tied up in these illiquid investments. It was truly a wake-up call for these investors once they were able to finally redeem their funds — some at 50 to 75 cents on the dollar. They were willing to take a loss just to get out of the investment. Some who hung in there for the long term are beginning to see normalcy return to this market.

The financial crisis is now ten years old, and was a game changer in many respects. Liquidity became paramount to investors. First Republic wealth managers have always placed a premium on liquidity, since our personal philosophy is based on maintaining our clients’ ability to tap their money at a moment’s notice.

Today, these asset classes continue to be an important part of a diversified portfolio but are now in different structures. An important, positive outcome of the 2008 period was the restructuring of many of these alternative strategies into mutual funds, which does provide liquidity to investors for these kinds of strategies and allows investors who were once considered too small to invest in these funds to round out their portfolios.

Circling back to our original premise of searching for ways to increase return while reducing risk in an increasingly diversified portfolio, asset allocation using these non-correlated assets in mutual funds now provide a mainstream avenue and the much-needed liquidity for these alternative investments.

Lastly, when reviewing your holistic investment portfolio as it relates to alternatives, asset “location” must be considered. Alternatives can potentially be optimal for the tax-deferred segment of your diversified portfolio, as many of these investments are tax-inefficient. As always, it is crucial to partner with your wealth manager to build a strategy unique to your goals and objectives.

Alternative or “alt” mutual funds are publicly offered, SEC-registered funds that use investment strategies that differ from the buy-and-hold strategy typical in the mutual fund industry. Compared to a traditional mutual fund, an alternative fund typically holds more non-traditional investments and employs more complex trading strategies. Investors considering alternative mutual funds should be aware of their unique characteristics and risks.