|

This is part of a series with Dennis T. Jaffe, Ph.D., in partnership with First Republic’s Family Engagement and Governance team. Dr. Jaffe is a leader and an author in the field of family enterprise consulting. An organizational consultant and a clinical psychologist, he helps multigenerational families develop governance practices that build the capability of next-generation leadership and advises financial organizations and family offices on serving family clients. First Republic is honored to collaborate with Dr. Jaffe and share a special series highlighting his findings from successful family enterprises: 8 Insights From Long-Lasting Global Business Families |

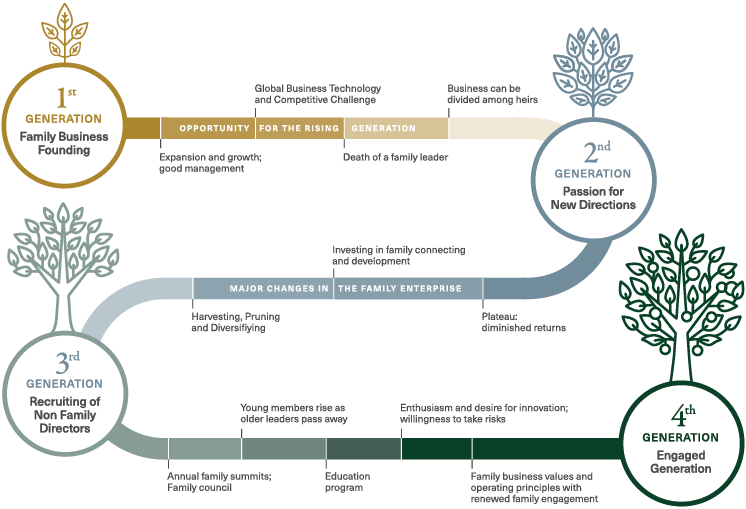

Generative families see themselves as being on a journey, continually reinventing themselves. Each family can define specific key events marking changes and developments.By the third generation, none of the families in our study contained the same business mix with which they began. Each generation redefines and renews its business and financial activity to sustain their wealth for a growing number of family members. The old effective business practices need to be updated and redefined for new realities. The family, not designed to allow huge changes, must learn to become resilient as it faces upheaval in the business environment. As it enters an especially volatile era, it needs to deal with unforeseen adversity.

Four transformations during evolution

While every journey is different, families report four major transformations as they evolve. They occur in different ways and at different rates.

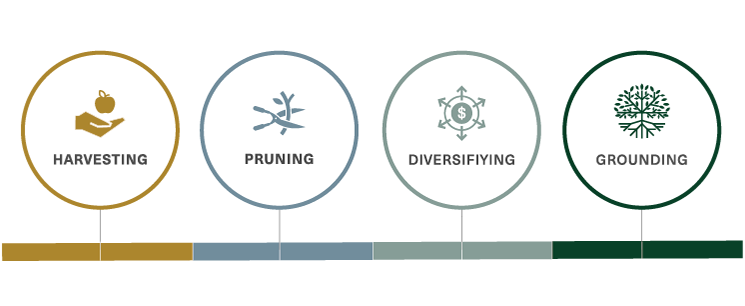

- Harvesting: Over time, generative families harvest significant wealth from their legacy business and other investments and must decide what to do with it. Even if they maintain only their legacy business, the family accumulates wealth outside the business. Most families experience some sort of liquidity event, which is another transition point. The family has to decide what to do next and whether they want to continue as a shared financial entity. Increasing wealth, or a sudden unexpected event, creates an opportunity for the family to add assets and redefine their business strategy and mix. Generative families decide to invest much of their wealth together rather than distribute it to each owner.

- Pruning: As the family grows, some households and even branches decide they no longer want to be part of the family partnership. Every family in the study had some households choose to exit to ensure that those who remain share the values and commitment.

- Diversifying: As each generation adds to the family wealth, the family works to contain a portfolio of entities. These include one or more legacy businesses, real estate assets, investments, family vacation properties and philanthropic foundations, all of which must be stewarded. The increasing mix of assets challenges the family to redefine its governance and leadership to align different goals and overcome conflict.

- Grounding: The family must take steps to sustain its identity by gathering and including new family members as they enter and come of age, reaffirming their commitment to partnership. Aligning the growing family is a continual challenge, necessitating constant exchange and negotiation. The family office becomes the home for these family and business activities.

Resilience and renewal

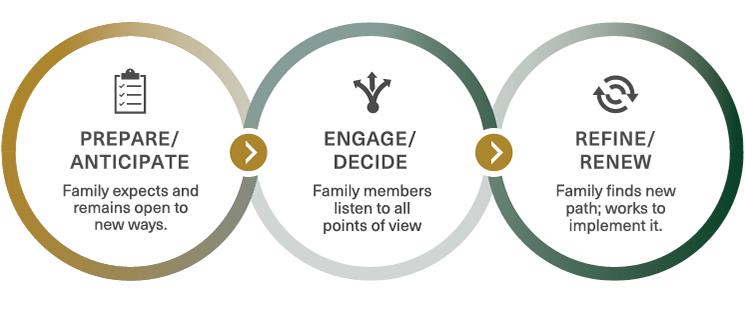

We see a three-phase resilience cycle in how generative families respond to change.

- Prepare/anticipate: Even when it is not preparing for a specific change, the family expects and anticipates broad general changes, such as the need to develop a new generation of family members or prepare for a shift of customers or products. It notices early warning signs and faces their import.

- Engage/decide: As a change approaches, the family gathers to consider what it means. The family engages multiple members and listens to differing points of view before it acts.

- Redefine/renew: After the change, the family does not go back to the way things were. Members find a new path and work to implement it. While they respect tradition, they are able to let go of anything that is obsolete.

Learnings from long-lasting global business families

Look ahead to threats and challenges within the family and in the business environment.

No social system is immune from change, whether a family or a business. Despite this reality, most systems expect the current reality to continue and resist efforts to prepare or anticipate change. Current success can fade as new conditions arise. Capable family leaders die, move on or lose their touch, and they have to be replaced. A family enterprise should regularly perform what is called a SWOT analysis, defining and facing up to the strengths, weaknesses, opportunities and threats that lie ahead. While experts can help with this exercise, generative families find that it is something that should be open and should engage a number of family members, especially young people who might see themselves in future roles. The family should set aside time to discuss their SWOT findings and consider how to anticipate and respond to them by building on their resources and making possible changes.

Allow family members free choice to leave or remain in the family enterprise.

You are born into a family, but most people grow up and create their own destinies, even when they benefit from having inheritance and using family resources. However, if there is a substantial family enterprise or trust, a family member may find that the luck of their birth turns into a life sentence when partnering with siblings and cousins, who may be very different. Generative families have some trusts and holdings that cannot be split, but they usually offer an opportunity for family members to be bought out and leave some or all family enterprises to go off on their own. There are clear procedures and rules; separation is a very consequential decision, but it is a safety valve for families that run into differences or conflict about what they will do. Some families act early and split holdings to allow family branches to separate, or they offer different assets to each sibling, encouraging and supporting different paths. Not every family is destined to be a business together forever or even for another generation. Each generation should make its own decision about whether family members want to remain as partners. When involvement is a free choice, young family members feel invited to share their ideas and offer their energy to the ventures of the family. Free choice encourages active partnerships, across generations, among family members who want to be part of the effort.

Seek and explore new opportunities.

The family enterprise, business or financial entity has been successful for more than a generation, but change is on the horizon. Often, rising generation family members, with their education, travel and work experience, have a pulse on the future. The generative family engages family members in surfacing, developing and supporting innovations and new business opportunities. They often create a business innovation council, or family bank, to discover new opportunities for the family. Why is it important to engage all stakeholder groups, especially the rising generation? They represent the future and are expected to carry out the strategy, so it is important to involve them. Also, their creative ideas can come from areas that the elders and professional advisors are not aware of, bringing new opportunities and dimensions to the family. This builds resilience and adds an adaptive resource.

Develop a family “place” that is separate from the business.

While the family continually changes, it also wants to maintain its special identity and culture that may go back a generation or more. The family has to make sure that change does not lead members to lose touch with who they are and find ways to sustain common purpose. Families often have a special vacation place — a ranch or resort property or a family office — that has space for family members to gather and even keep special objects, like pictures, mementos and art, that rekindle their connection to what is unique and special about them.

Every successful family enterprise has to reinvent itself with each new generation. Some family members may choose to leave, while others want to participate in renewing the family and its businesses. A family has to expect to be deeply transformed in every generation, and to be resilient, a family has to anticipate and prepare for deep change.

Insight 6 Active Cross Generational Stakeholder Alliance

Introduction: 8 Insights From Long-Lasting Global Business Families

This information is governed by our Terms and Conditions of Use.