Mobile Banking Security

Mobile Banking Security

Helpful security tips to protect you when using mobile devices, tablets and laptops.

Mobile Banking Security

When you use a mobile device such as a smartphone (Blackberry, iPhone, Android, etc.), tablet (iPad) or laptop computer for browsing the Internet or text-based account access, these tips will help protect you:

When you use a mobile device such as a smartphone (Blackberry, iPhone, Android, etc.), tablet (iPad) or laptop computer for browsing the Internet or text-based account access, these tips will help protect you:

- Use the keypad lock or phone lock function on your mobile device when it is not in use. These functions password-protect your device to make it more difficult for someone else to view your information. Also be sure to store your device in a secure location.

- If no longer needed, delete text messages and email from your financial institution, especially before discarding or selling your mobile device.

- Avoid disclosing personal identifying or financial information via text message, phone call or email. This includes account numbers, passwords, Social Security number, birth date, mother’s maiden names and security questions and answers.

- If you lose your mobile device or change your mobile phone number, remove the old number from your mobile banking profile at www.firstrepublic.com or call the Customer Care Center at (888) 408-0288.

How To Endorse Checks for Mobile Deposit

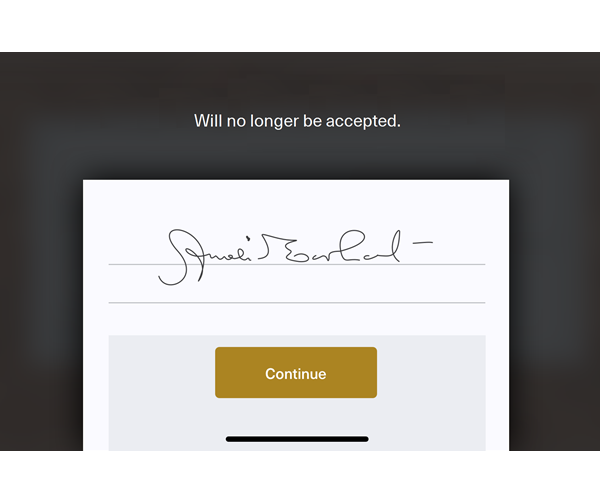

In order to reduce check fraud risk, First Republic has updated instructions for depositing checks via mobile check deposit:

Instructions for mobile check deposits:

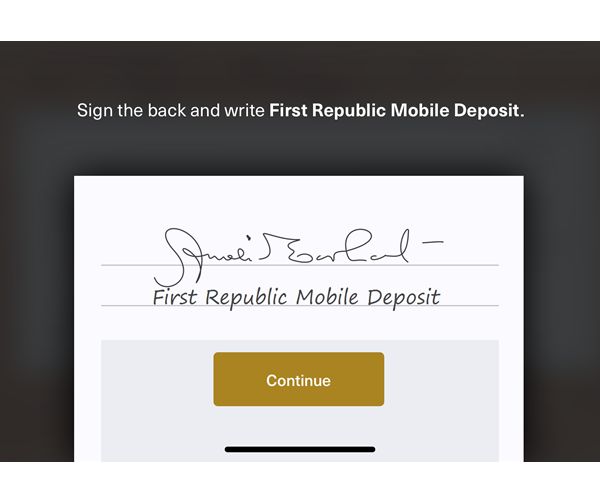

- Please include your signature at the top of the back of the check.

- Please endorse your check with the phrase “First Republic Mobile Deposit” beneath your signature on the back of the check (see example below).

We appreciate your assistance in helping reduce fraud. For more information, see the FAQ below or call Banking Online Support at (855) 886-4819.

- What types of deposits are affected by this change?

- Checks deposited via mobile check deposit on a mobile phone or tablet are subject to the updates.

- Is First Republic the only bank making this change?

- First Republic is among many banks updating electronic check deposit processes to reduce the risk of duplicate deposits. Exact endorsement instructions may vary from one financial institution to another.

- How has this regulation changed the Terms and Conditions for my digital banking or corporate online account?

- The Terms and Conditions for both digital banking and corporate online banking have been updated to reflect these changes.

- Digital Terms of Use for Consumer Digital can be found on the Digital Banking site and the mobile app after you sign in:

- Digital Banking: Click Digital Terms of Use, found in the footer at the bottom of your screen.

- Mobile App: Tap More, then tap Legal and finally tap Digital Terms of Use.

- Corporate Online Terms and Conditions