Go paperless.

Go paperless.

Why go paperless?

-

Delivery is safe and secure.

Reduce lost mail falling into the wrong hands and get alerts when online statements are ready. -

Statements are always available.

Access up to seven years’ worth of statements on the app or online. -

Document shredding is eliminated.

Help the environment and reduce the chances of identity theft.

Go paperless on the mobile banking app.

-

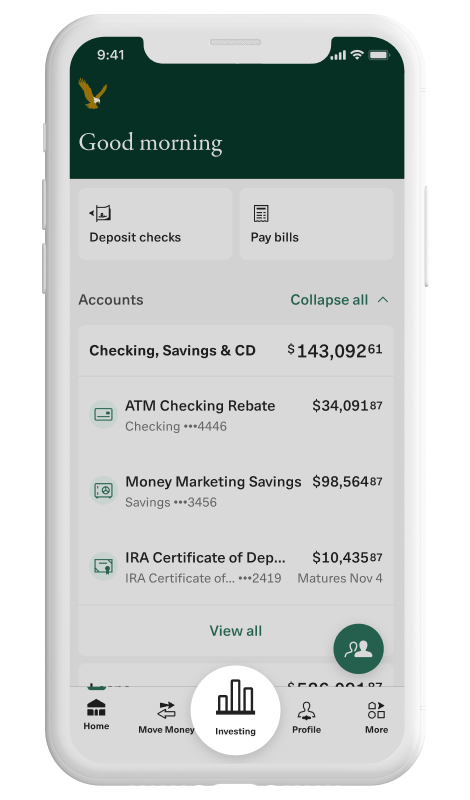

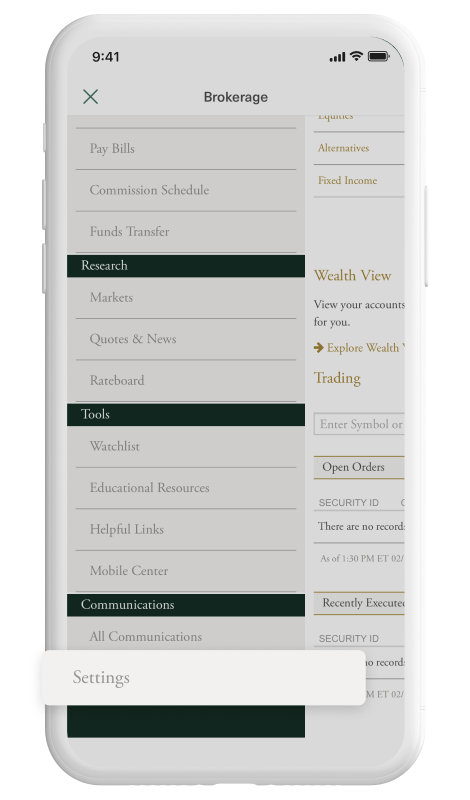

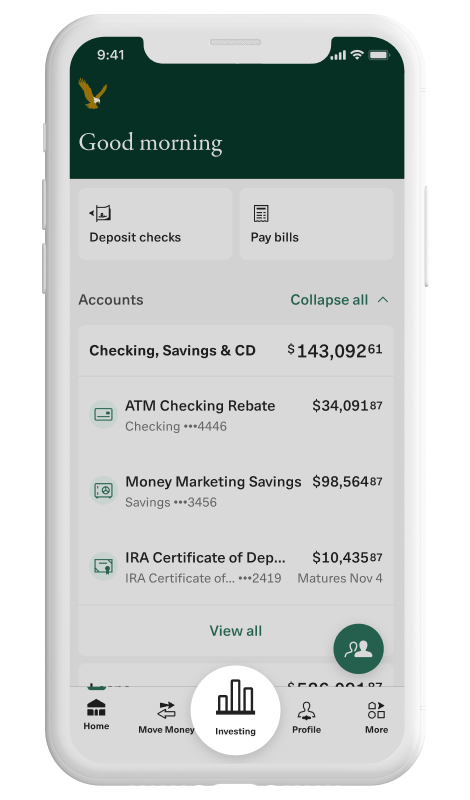

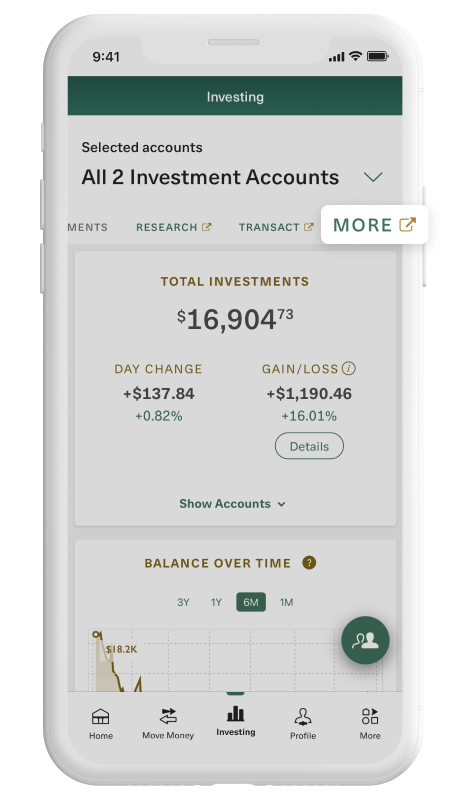

01

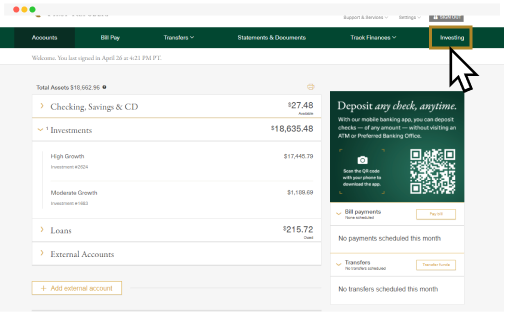

Tap Investing.

-

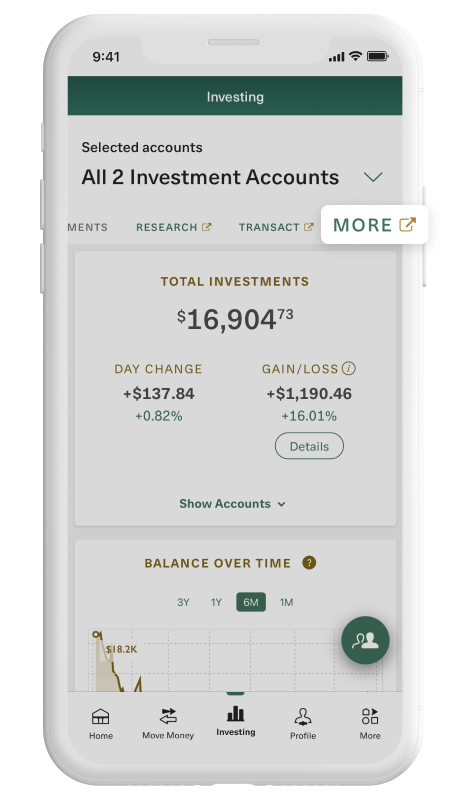

02

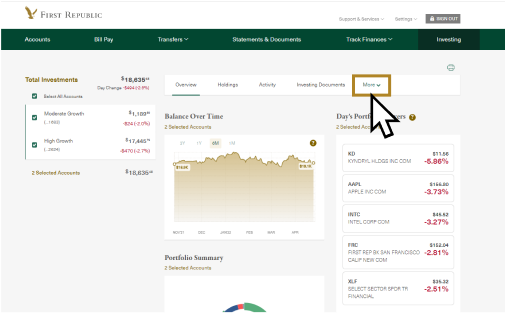

Tap More.

-

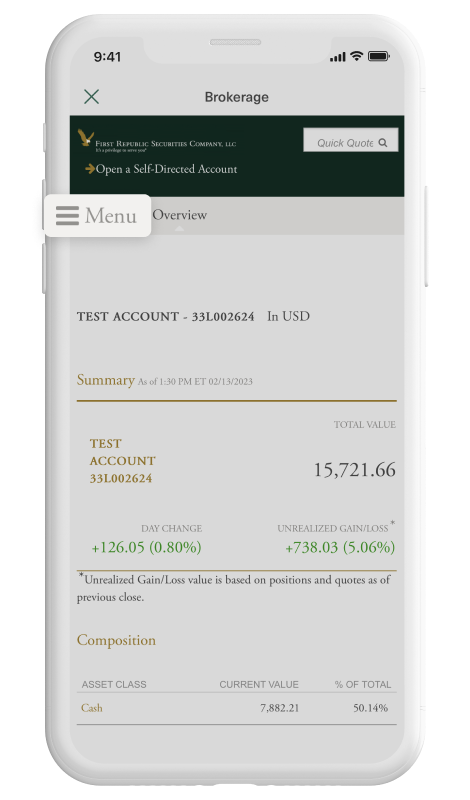

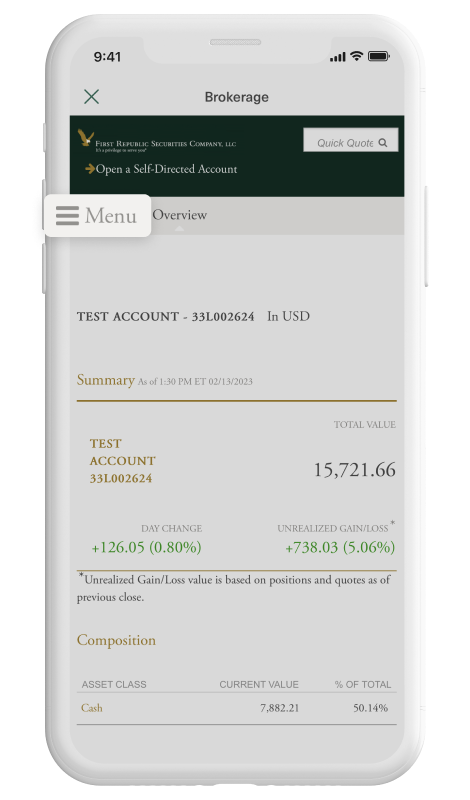

03

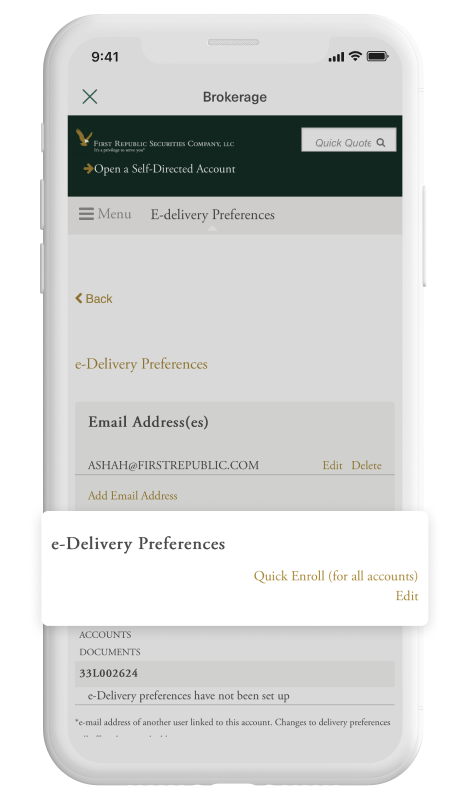

Tap Menu.

-

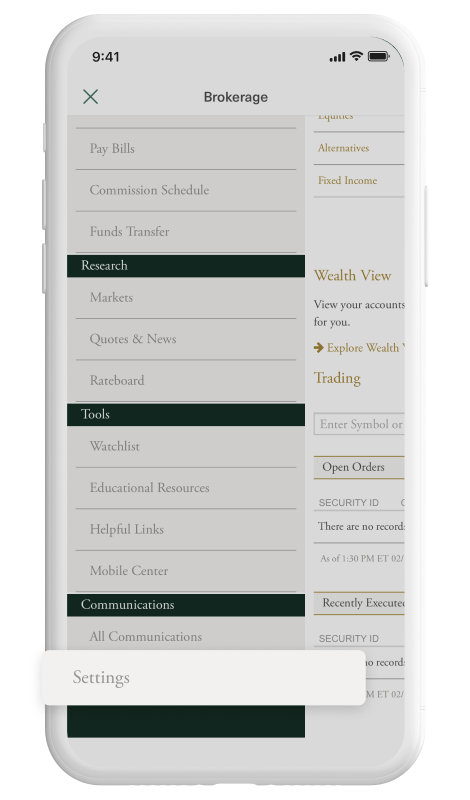

04

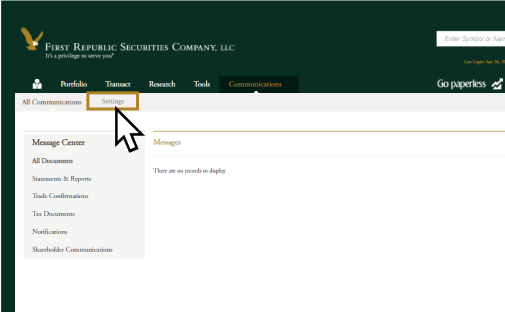

Select Settings.

-

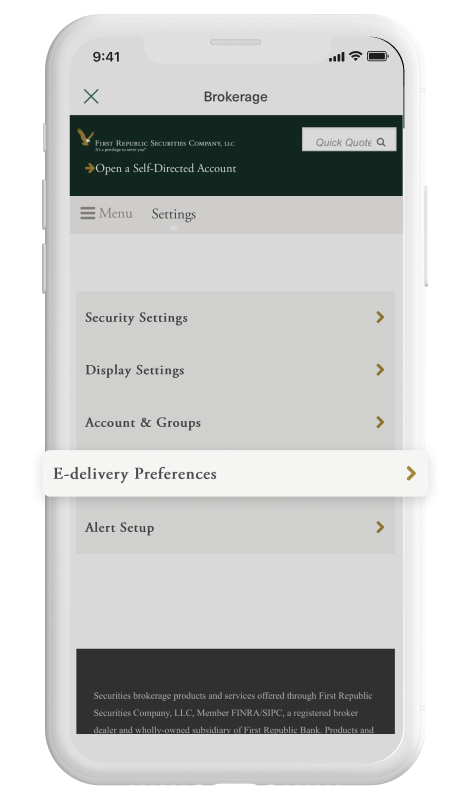

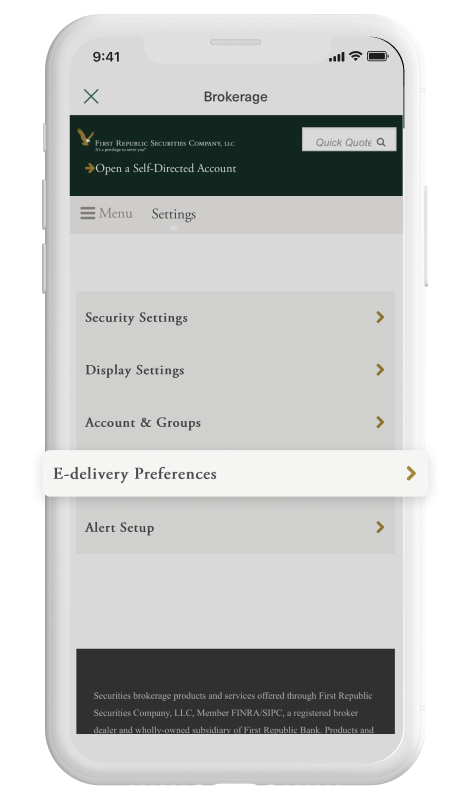

05

Tap e-Delivery Preferences

-

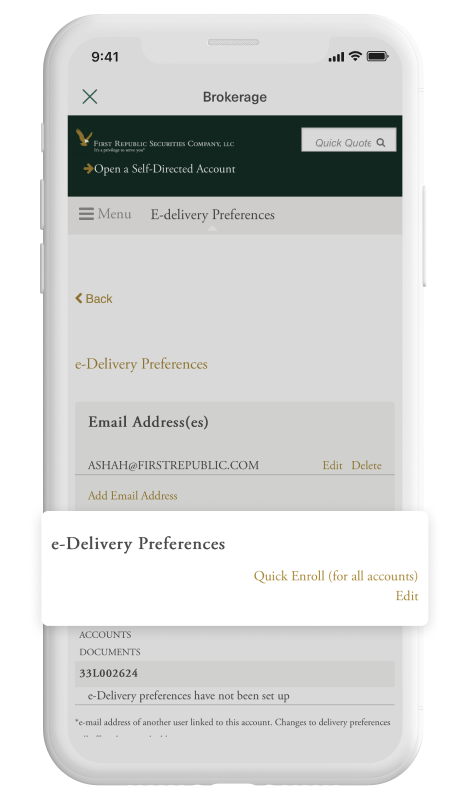

06

Tap Edit. under e-Delivery Preferences.

-

07

Select the documents and tap Save.

Go paperless on the mobile banking app.

-

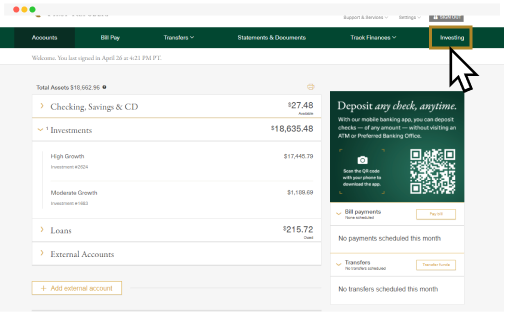

01

Tap Investing.

-

02

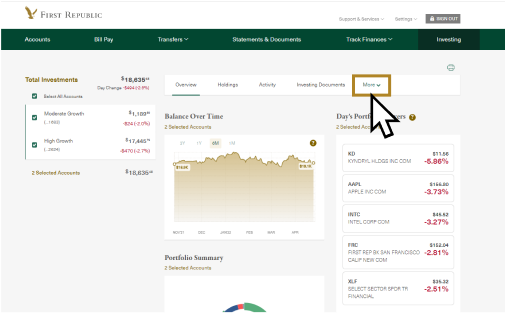

Tap More.

-

03

Tap Menu.

-

04

Select Settings.

-

05

Tap e-Delivery Preferences

-

06

Tap Edit. under e-Delivery Preferences.

-

07

Select the documents and tap Save.

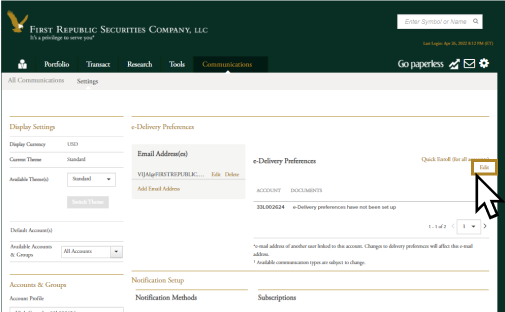

Go paperless on Banking Online.

-

01

Click on Investing.

-

02

Click the More menu and any option.

-

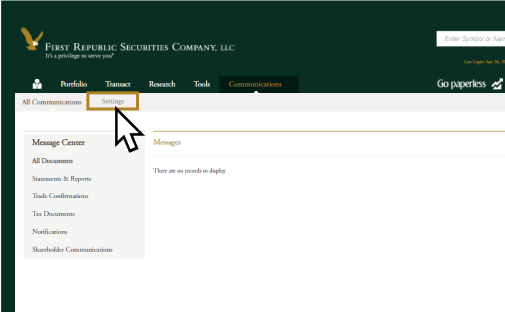

03

Click onSelect Communications.

-

04

Select Settings.

-

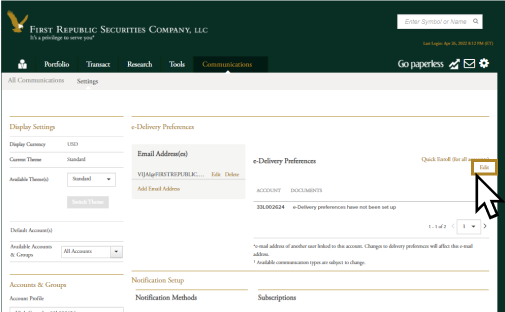

05

Click Edit under e-Delivery Preferences.

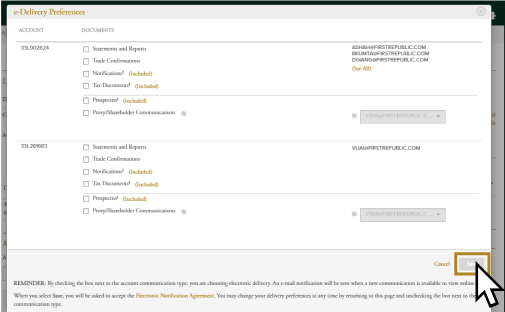

-

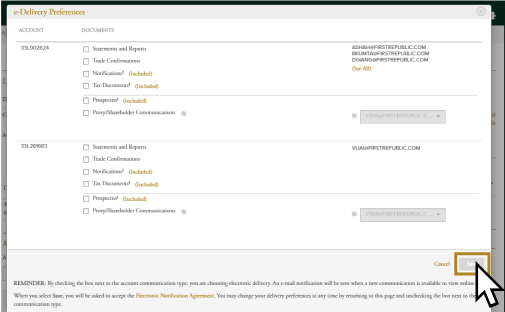

06

Select preferences and click Save.

Go paperless on Banking Online.

-

01

Click on Investing.

-

02

Click the More menu and any option.

-

03

Click onSelect Communications.

-

04

Select Settings.

-

05

Click Edit under e-Delivery Preferences.

-

06

Select preferences and click Save.

Get started.

Download the First Republic mobile banking app.

If you don’t have a First Republic Banking Online account, call (855) 886-4819.

Learn how to get started on mobile

-

Connect with a Specialist.

Email or call a Digital Specialist for help getting started.

(855) 886-4819

-

Enroll in Banking Online.

Complete the online form and we’ll be

in touch. -

Already a client?

If you have a login for Banking Online, you can sign in now.

Sign in

Get started.

Download the First Republic mobile banking app.

App Store is a service mark of Apple Inc. Google Play and the Google Play logo are trademarks of Google LLC.

-

Connect with a Specialist.

Email or call a Digital Specialist for help getting started.

(855) 886-4819

-

Enroll in Banking Online.

Complete the online form and we’ll be

in touch. -

Already a client?

If you have a login for Banking Online, you can sign in now.

Sign in

Privacy Center

|

Your Privacy Choices ![]() |

Security & Fraud Prevention

|

Accessibility

|

Website Terms & Conditions

|

Security & Fraud Prevention

|

Accessibility

|

Website Terms & Conditions

Deposit products and related services are offered by JPMorgan Chase Bank, N.A. Member FDIC.

Equal Housing Opportunity

Investing involves market risk, including possible loss of principal, and there is no guarantee that investment objectives will be achieved. Past performance is not a guarantee of future results.

J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment adviser, Member FINRA and SIPC. Certain advisory products may be offered through J.P. Morgan Private Wealth Advisors LLC (JPMPWA), a registered investment adviser. Trust and Fiduciary services including custody are offered through JPMorgan Chase Bank, N.A. (JPMCB) and affiliated trust companies. Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. JPMS, CIA, JPMPWA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co.

INVESTMENT AND INSURANCE PRODUCTS ARE:

• NOT FDIC INSURED

• NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

• NOT A DEPOSIT OR OTHER OBLIGATION OF, OR GUARANTEED BY, JPMORGAN CHASE BANK, N.A. OR ANY OF ITS AFFILIATES

• SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED

©2024 JPMorgan Chase & Co.