Every industry has its own professional jargon – terminology relied upon to quickly communicate within the industry – and a business is no exception. Since dedicated investment news stations were first introduced, and with their ongoing popularity, investment jargon has become commonly used in day-to-day life. However, is there the chance that comfort and familiarity with the lingo has caused people to be overconfident in their investment prowess? Are we missing the point of why we invest?

Goal-based investing helps investors navigate the question, “Why am I investing?” The process focuses on specific life goals to help individuals “bucket” investment assets to match. Investment performance is not focused on “beating the market,” which can often misalign risk and timeline, but on meeting a specific life goal.

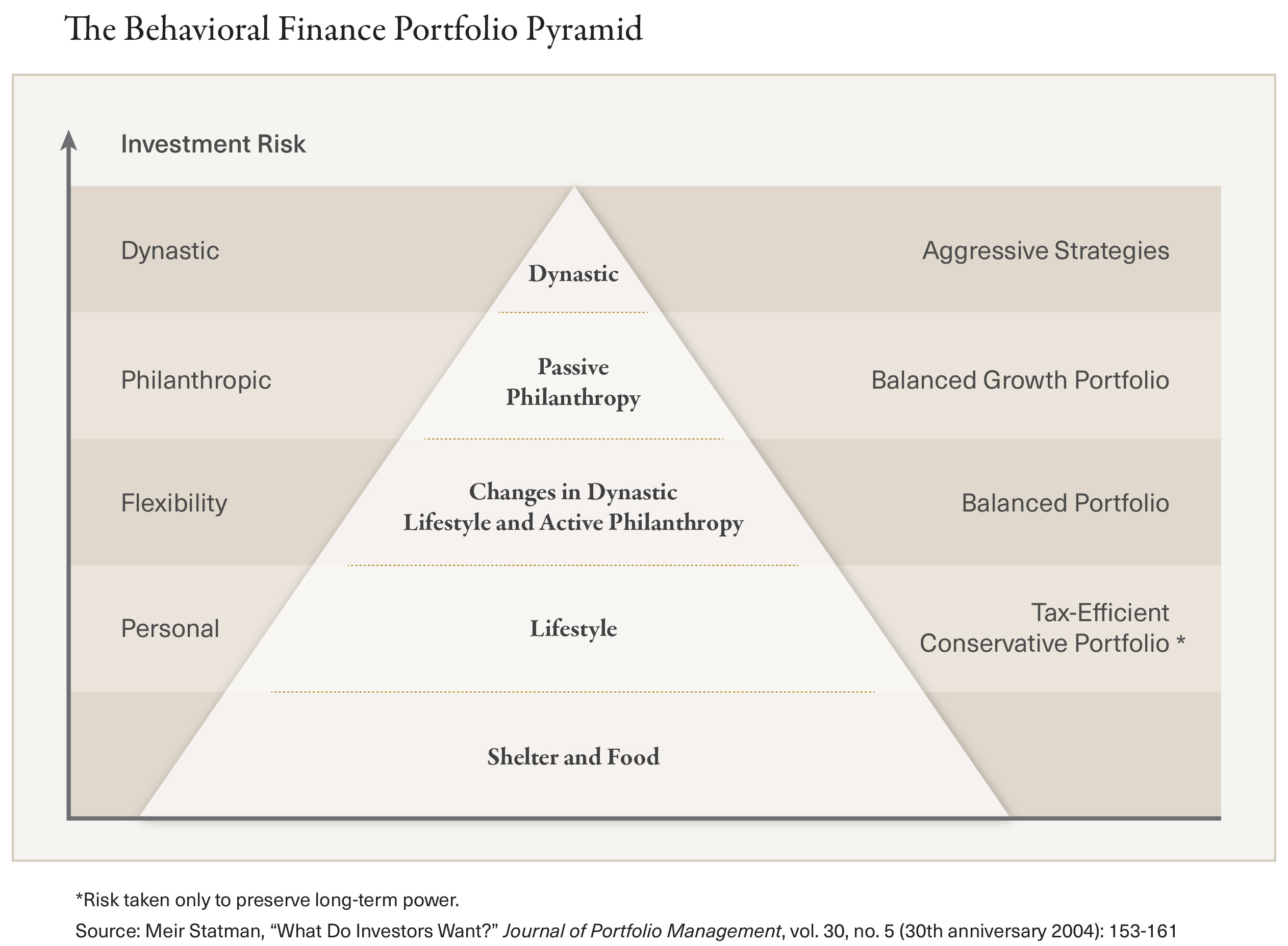

For example, we all need money for food and shelter. This is a “bucket” that would not be invested in risky assets to make sure basic needs are met, regardless of market conditions. In a goal-based framework, investors work with advisors on needs, goals and aspirations (short and long-term). This is often visualized as a pyramid with basic needs as the base and aspirations (such as philanthropic desires) at the peak.

In short, goal-based investing builds a portfolio on investors’ goals described in their own way. While more traditional methodology often aims for the highest returns possible, goal-based investing focuses on achieving the financial underpinnings of goals that carry personal value. Goal-based investing helps sort through objectives and dreams—separating those that are genuinely attainable from those that are less realistic. That can prove a sobering experience for some but, in the end, investors are empowered with the confidence that those goals to which they are genuinely committed are within reach. To that end, the advisor works to build a pragmatic and actionable investment portfolio geared to attaining those objectives.

An advantage to goal-based investing is leveraging behavioral finance—the emotional component of investing. Many investors, understandably, tend to focus—and fret—over short-term market movement. Given its emphasis on compartmentalizing assets into different objectives, it encourages investors to look past the immediate moment and instead keep their focus on the longer range horizon. That can head off costly, short-term reactions based on emotion and keep investors focused on achieving what truly matters most to them.

At First Republic, we believe this technique works better than more traditional methods. It both separates goals and clarifies the time horizon and risk tolerance for each goal. It also does a better job of matching assets and liabilities. In some cases, “buckets” can be created for guilt-free spending and in others, provides an important framework for discussing necessary savings rates.

In summary, next time you meet with your advisor, make sure attention is paid to what really matters to you – your life goals should be the focus of the conversation, not anything that would suggest otherwise.

This article is for information purposes only and is not intended as an offer or solicitation, or as the basis for any contract to purchase or sell any security, or other instrument, or to enter into or arrange any type of transaction as a consequence of any information contained herein.

All analyses and projections depicted herein are for illustration only, and are not intended to be representations of performance or expected results. The results achieved by individual clients will vary and will depend on a number of factors including prevailing dividend yields, market liquidity, interest rate levels, market volatilities, and the client's expressed return and risk parameters at the time the service is initiated and during the term. Past performance is not a guarantee of future results.

Investors should seek financial advice regarding the appropriateness of investing in any securities, other investment or investment strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realized.

©First Republic Investment Management, 2015